Location:Fixed Asset >> Fixed Asset Disposal

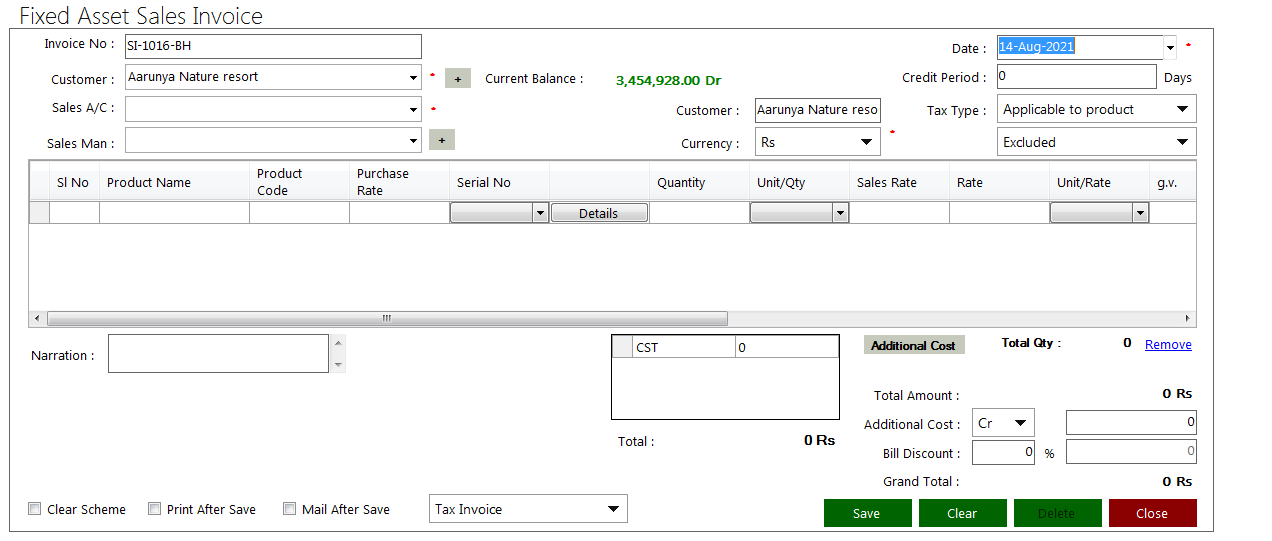

This is to enter the details related to fixed assets sales or disposal. The interface of the vouchers as follows.

Invoice No: The invoice number is appeared automatically. Can customize.

Customer: Here, the customer is the party who going to purchase the asset. The customer could be selected from the drop down list. At the moments, when the sales invoice is generating also can could be created the customer by clicking on + mark next to Customer field.

Sales A/C: As the sales account, it needs to select the DISPOSAL LOSS/GAIN account here.

Sales Man: If it has an assigned sales man for the particular transaction, he or she can be mentioned here.

Date: The current date appears automatically.

Credit Period: If the company has decided to confirmed credit period, it can be added here.

Tax Type: Tax details can be selected here.

-

After filling above details, it can be entered the sales product details next.

-

Here also it has the options of Print after save and mail after save.

-

Once it raised a fixed asset sales invoice at the moment the following double entry pass related to sales amount.

Customer Account Dr

Disposal Loss/Gain Account Cr

-

After this step, it needs to approve relevant disposal invoice for calculating the disposal loss / gain. It can be done by going through the path mentioned below.

Fixed Asset >> Register>> Sales invoice

It needs to select the relevant sales invoice from here and then open it. At the bottom of the invoice there is a button called APPROVE. Once it clicked on here, it appears a notification message as follows.

It asks to process for depreciation. The user needs to click on Yes if need to approve the disposal. Once it clicked on yes it directed to the DEPRECIATION REGISTER. Then it needs to click on PROCESS button to run depreciation for the asset. After that it appears as “FIXED ASSET UPDATED SUCCESSFULLY”. Once it approves all, it passes following entries.r

Disposal loss/Gain Account Dr

Accumulated Depreciation Account Dr

Fixed Asset Account Cr

Disposal loss/gain Cr / Dr